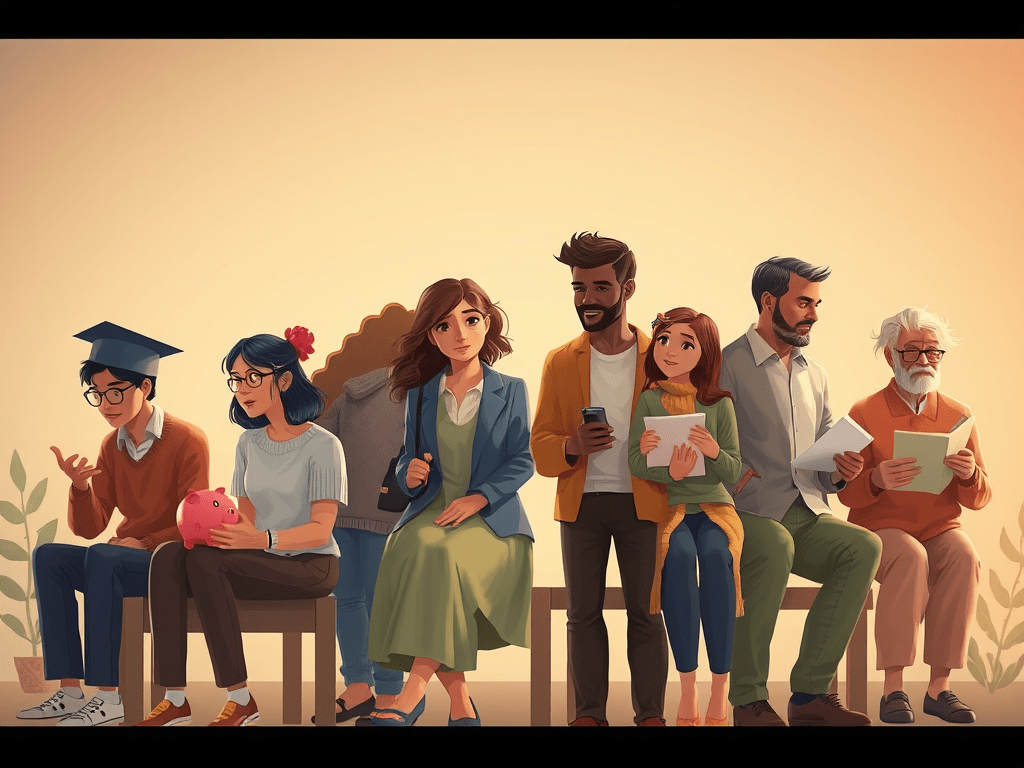

Most people talk about the big money milestones—graduation, your first job, buying a house, retirement. But what about the in-between stages that are just as important—maybe even more?

These are the hidden financial life stages that catch many Filipinos off-guard. They don’t get talked about in seminars or on the news, but they shape how we live, love, and lead our families.

Let’s uncover these stages, why they matter, and how you can prepare.

1️⃣ The “Sudden Breadwinner” Phase

When it happens: 20s to early 30s

What it feels like: You just started earning—and suddenly, everyone’s relying on you.

Why it’s overlooked: It’s a silent expectation in many Filipino households.

What you should do:

- Create a shared family budget with transparency.

- Build your emergency fund—at least 3–6 months’ worth of expenses.

- Get life insurance (like VUL) to protect your loved ones and build investments at the same time.

2️⃣ The “Income Plateau” Years

When it happens: Late 30s to early 40s

What it feels like: You’ve been working hard for years, but your salary isn’t growing like it used to.

Why it’s overlooked: You look “successful” on paper, so people assume you’re okay.

What you should do:

- Check for lifestyle inflation—are you spending more just because you’re earning more?

- Pay off high-interest debts and reassess your investment allocation.

- Explore side income or passion projects for financial growth.

3️⃣ The “Sandwich Years”

When it happens: 40s to 50s

What it feels like: You’re helping your kids AND your parents—and your own needs come last.

Why it’s overlooked: You’re too busy to even reflect on it.

What you should do:

- Get health insurance for your parents to avoid out-of-pocket shocks.

- Start or boost your child’s education fund early.

- Consider a long-term care plan or VUL with riders that cover critical illness and hospitalization.

4️⃣ The “Pre-Retirement Drift”

When it happens: Late 50s

What it feels like: You’re getting closer to retirement—but you’re not sure if you’re ready.

Why it’s overlooked: You feel like you still have time, but the window is closing fast.

What you should do:

- Calculate your retirement readiness (monthly needs x 12 months x expected years).

- Shift to lower-risk and diversified investment options like UITFs, MP2, or conservative VUL funds.

- Think about your withdrawal strategy—how you’ll live on your money without outliving it.

5️⃣ The “Post-Career Hustle”

When it happens: 60s and beyond

What it feels like: You’re retired, but you still want (or need) to earn.

Why it’s overlooked: Most people assume retirement is about full rest.

What you should do:

- Find ways to consult, freelance, or mentor to supplement income.

- Monitor your investment drawdown rate to ensure your funds last.

- Enjoy your time—but stay financially alert.

🏁 Bonus: The “Wealth Transfer Prep” Stage

When it happens: Any time after 50

What it feels like: You’re preparing for what happens after you’re gone.

Why it’s overlooked: Cultural taboo. We don’t talk about death in Filipino homes.

What you should do:

- Create or update your will.

- Talk to your heirs—transparency avoids future conflict.

- Use life insurance as a tool for estate planning and tax efficiency.

💬 Final Thoughts

Nobody teaches us these things in school or even at home. But facing them head-on makes all the difference.

You don’t need to do it alone.

✅ Ready to face your hidden financial stage?

Let’s talk. I offer free Financial Wellness Assessments designed around YOUR life stage.

Message me or book your free session here 👉 Book Now!

Leave a comment